The Magic of RICh

The simplest DCA method explain for layman

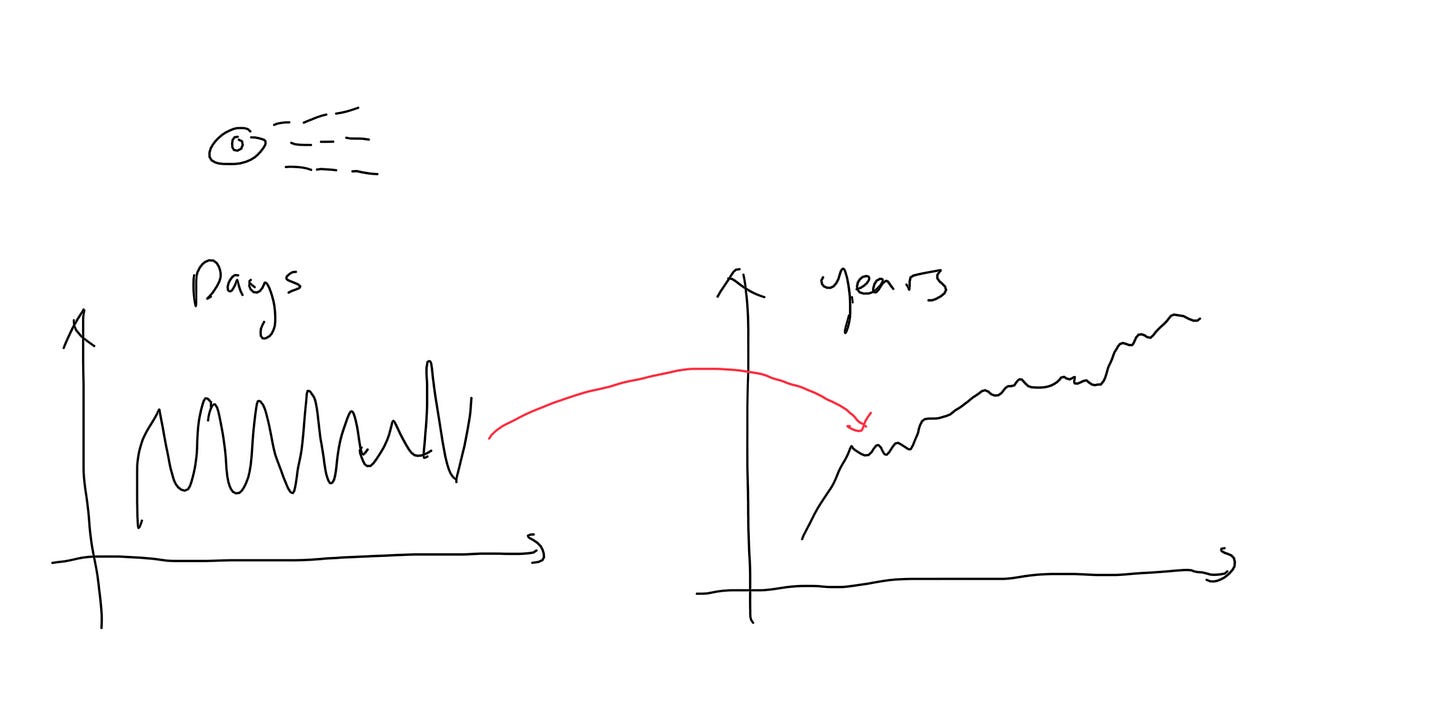

Why do most novice investors lose money?

They get caught up in the daily ups and downs of the market, reacting to short-term fluctuations.

What makes a successful investor?

They focus on the long term and are rewarded by the market's overall growth.

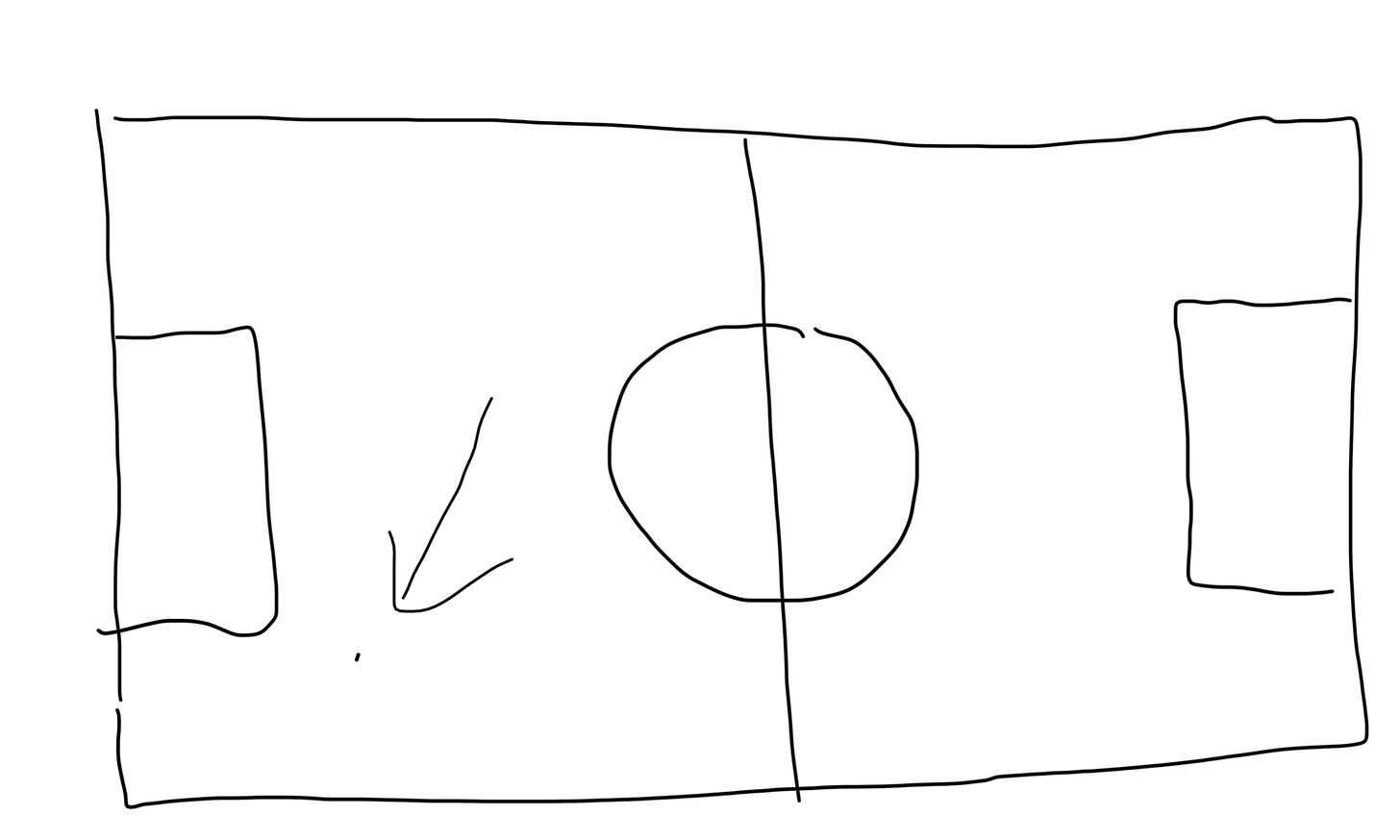

Can you time the market perfectly?

No, it’s impossible to time the market consistently. Picture yourself as a tiny bug on a vast football field—overwhelmed by the scale and unpredictability. You have no idea where you are in the football field; it’s like you will never know you are at the top of the market or the bottom. You never know what’s coming.

The pandemic that crashed the market in 2020

Housing bubble that crashed the US market in 2018

The internet bubble that burst in 2000

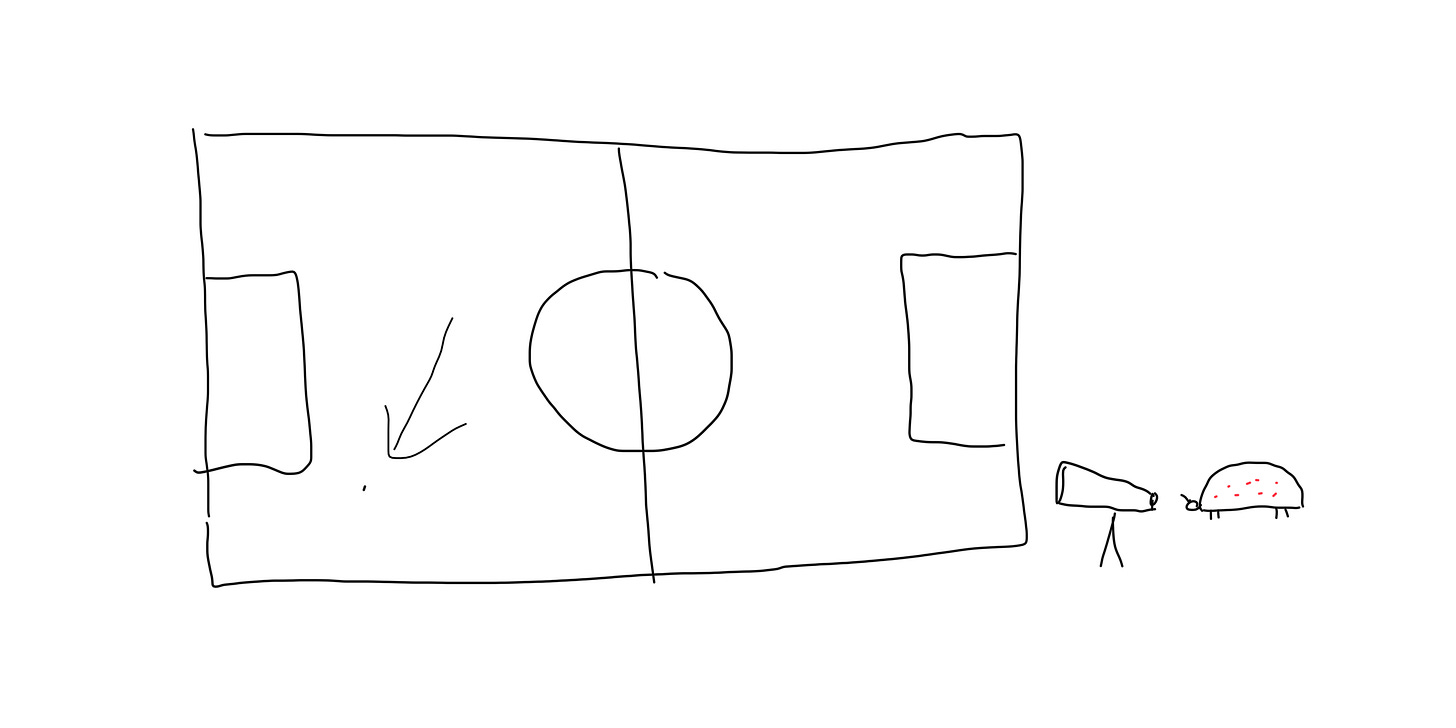

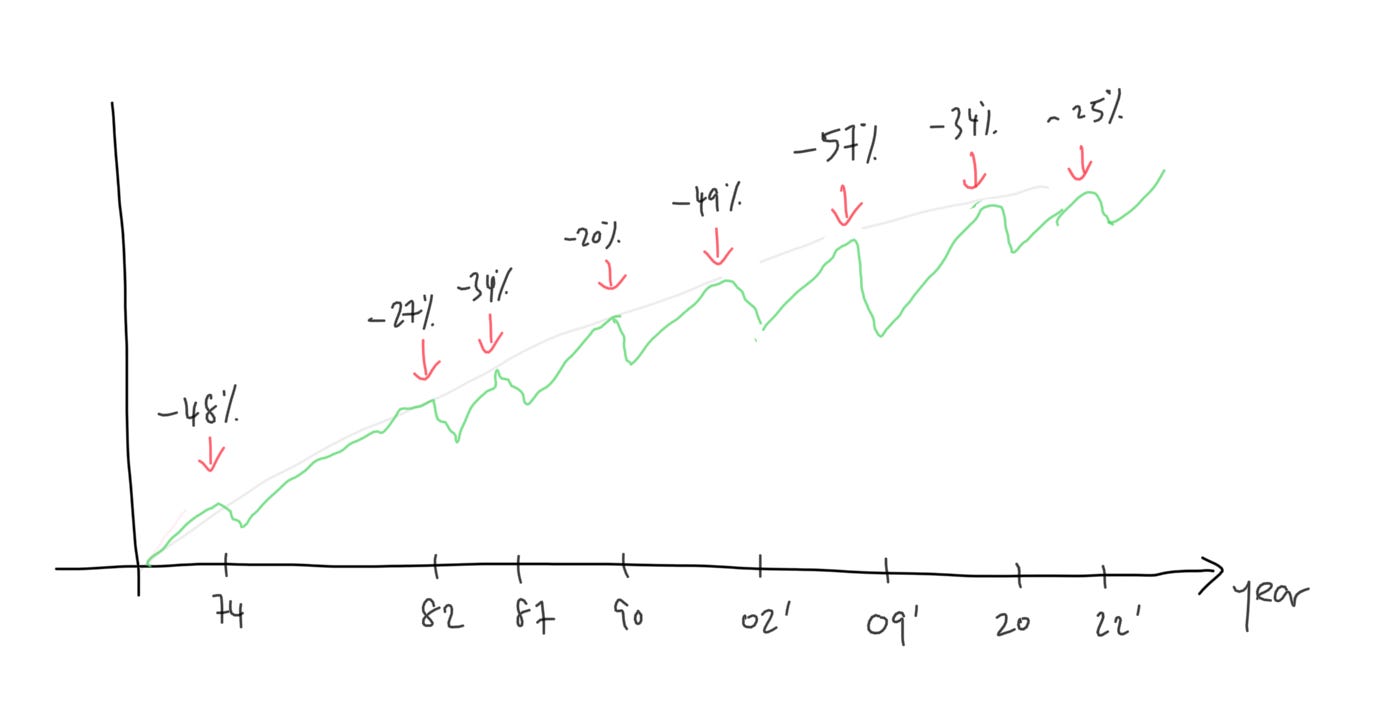

Is the stock market predictable in the long term?

Yes, over the long term, the stock market tends to be predictable. Imagine you’re the same little bug, but instead of being inside the football field, you’re on top of the stadium with binoculars—suddenly, you can see everything.

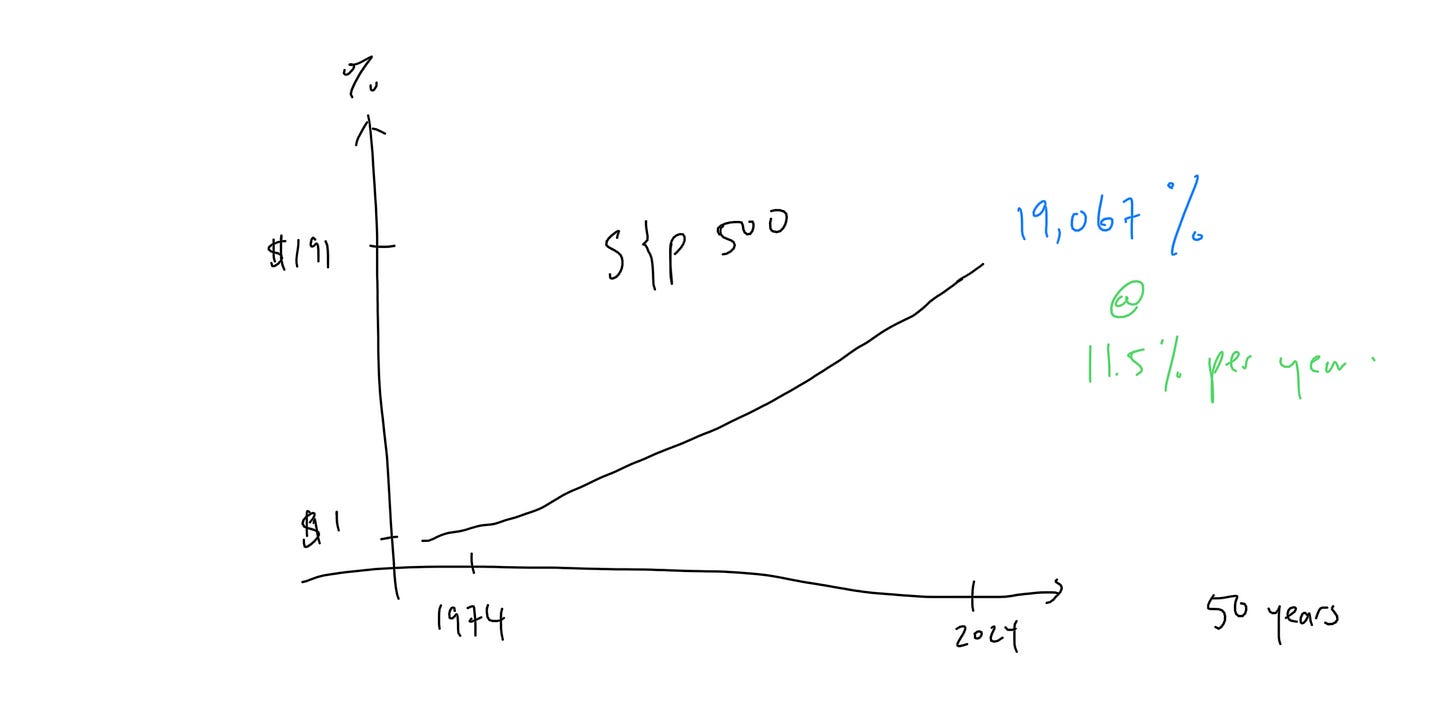

What can long-term investing achieve?

Over 50 years, the S&P 500 grew from $1 to $191.67, delivering a total return of 19,067% with an average of 11.5% per year. Patience and a long-term perspective can turn small investments into significant gains.

long-term, the market is very predictable.

Market will have some up’s and down, but the overall trend is still up

1973–1974 Bear Market | -48% | 21 months

1980–1982 Bear Market | -27% | 20 months

1987 Crash (Black Monday) | -34% | 3 months

1990 Recessio | -20% | 3 monhs

2000–2002 Dot-Com Crash | -49% | 31 months

2007–2009 Global Financial Crisis | -57% | 17 months

2020 COVID-19 Crash | -34% | 1 month

2022 Inflation Bear Market | -25% | 9 months

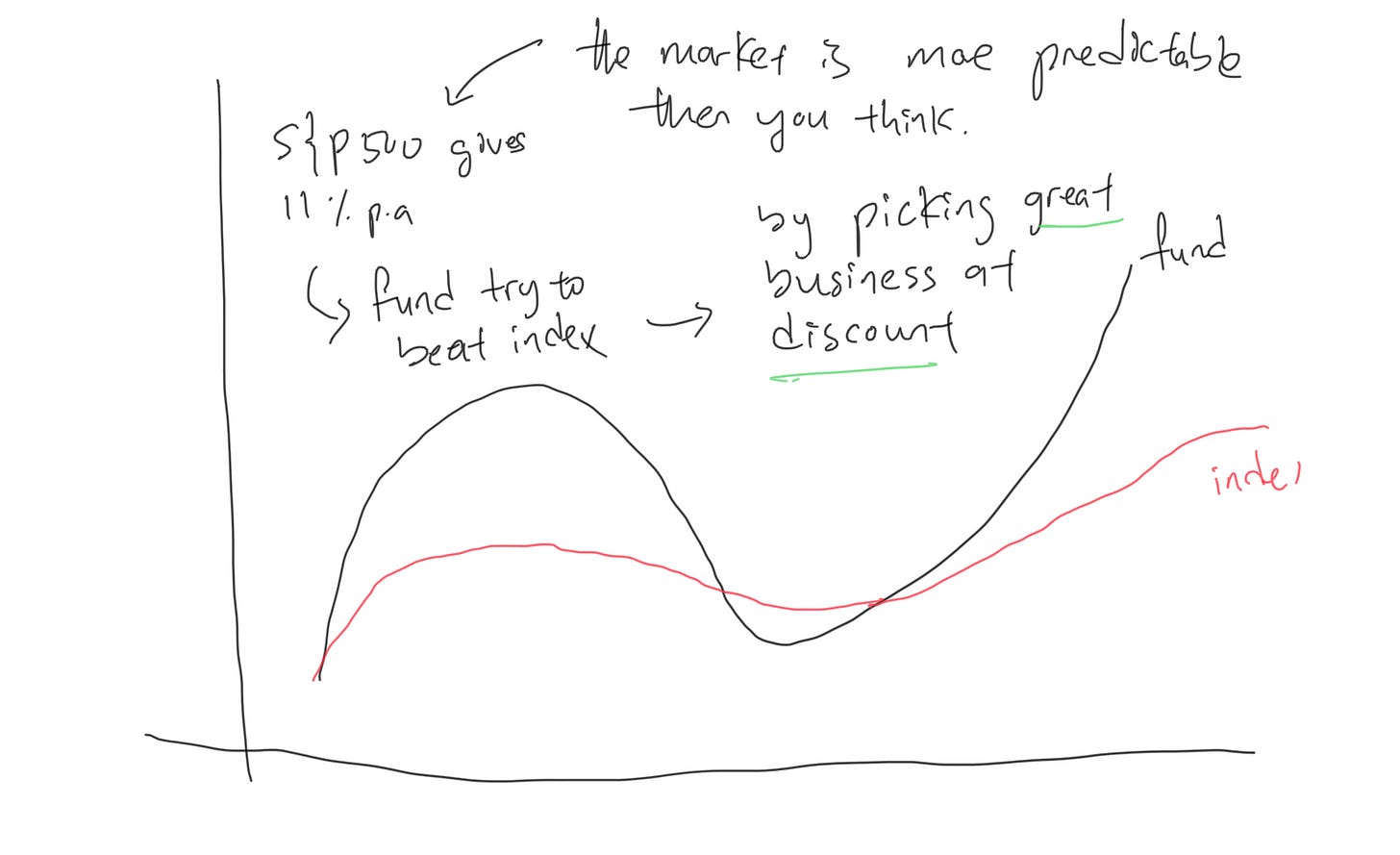

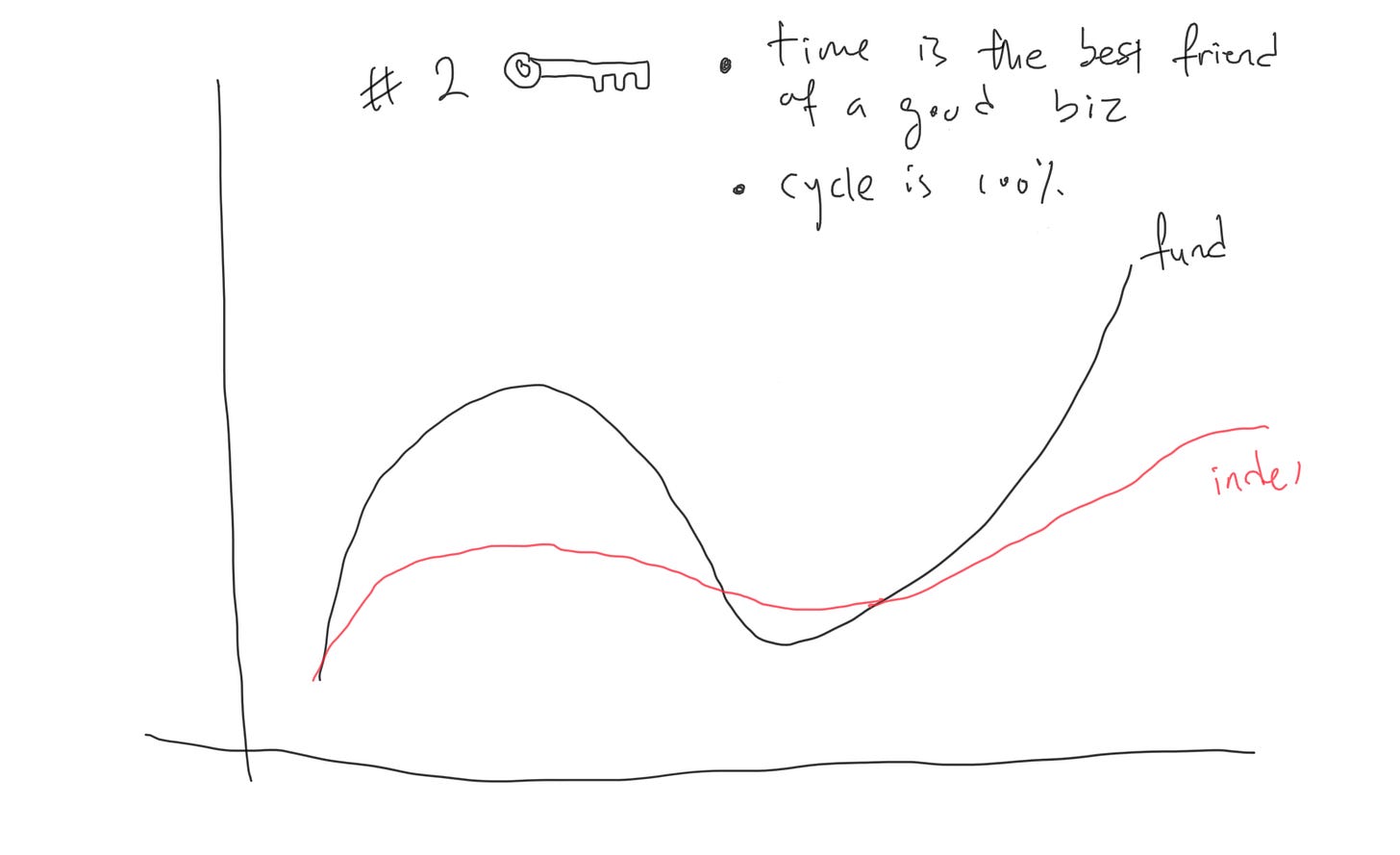

When we invest in Unit Trust / Mutual fund, our goal is to find good funds that can beat the market (index) long term

Two keys here. Time in the market is your best friend. → Refer to point no:5

This means it’s better to stay invested for the long term rather than trying to buy and sell quickly to catch the perfect time.

Markets have cycles—they go up and down. → Refer to point no:6

Understanding that price rises and falls are normal helps you stay patient and avoid panic.

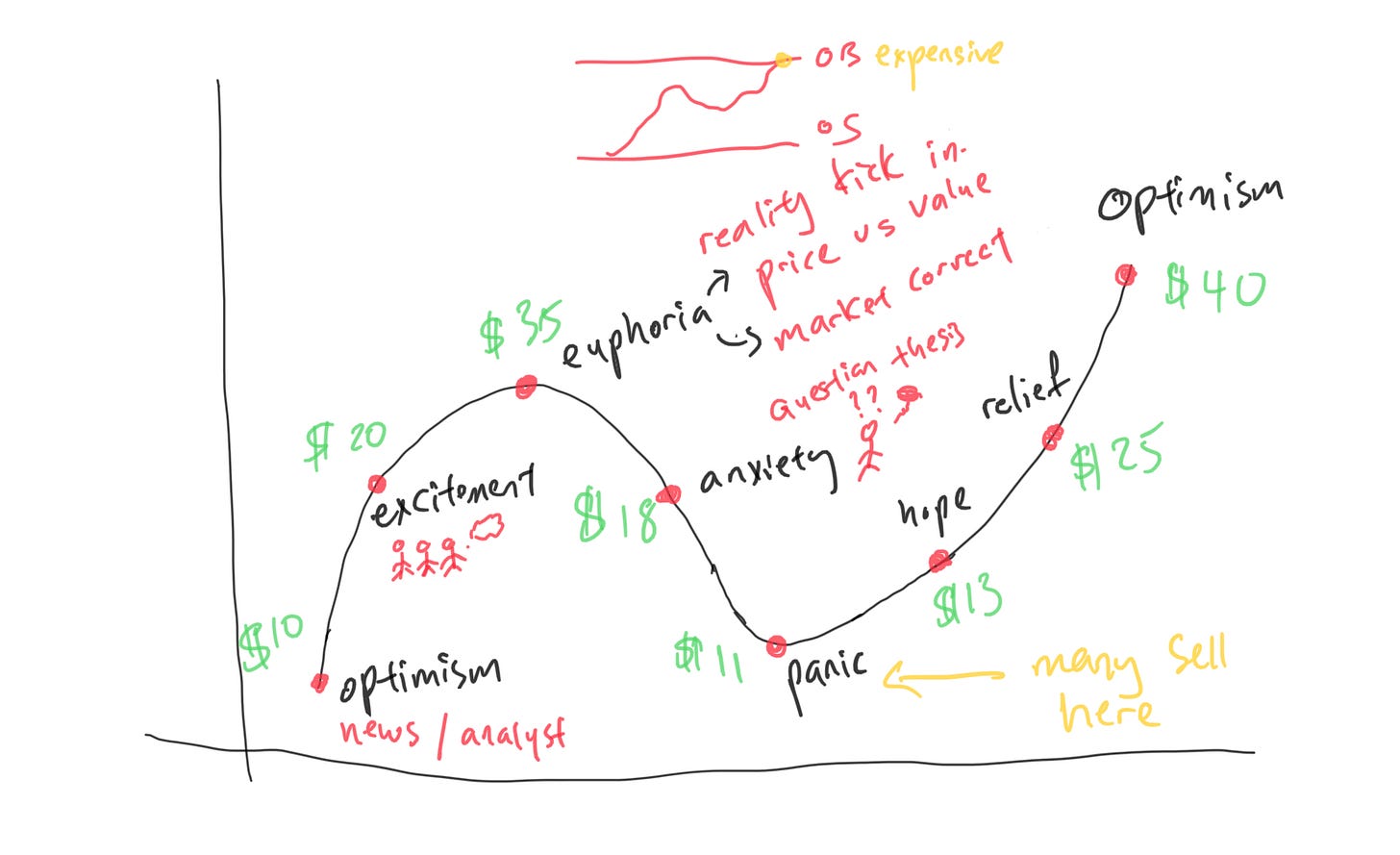

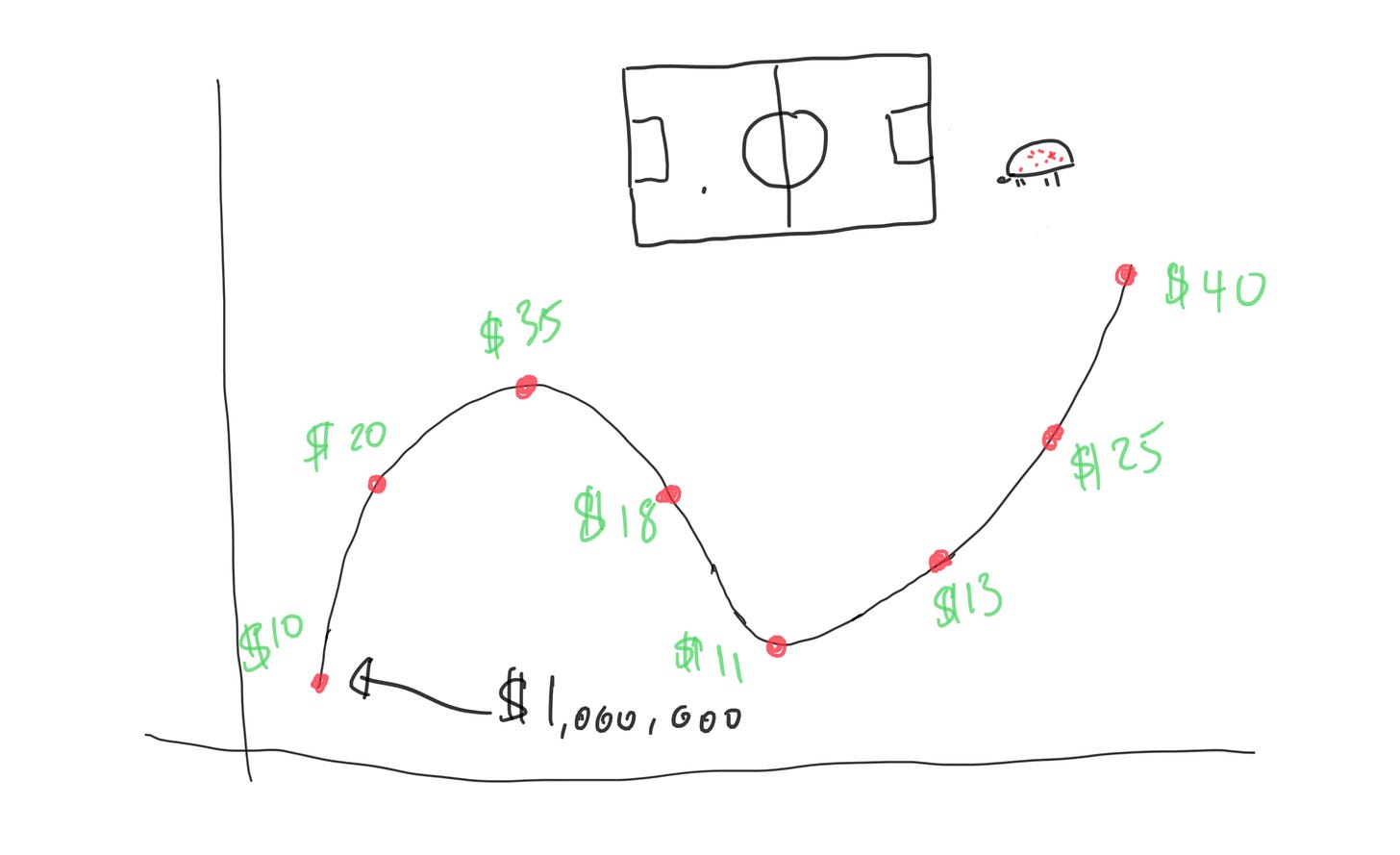

The problem is human emotion

Imagine you buy a stock at $10, and you’re lucky because you buat the the lowest & the price goes up to $20. You feel excited when it even reaches $35.

But then the price starts to drop. It falls to $18, and you begin to feel nervous. You wonder if you should sell or hold on.

Then the price keeps falling to $11. You panic and sell because you’re afraid it might go even lower.

A smart investor, however, buys at $10 and ignores all the ups and downs. They stay calm, and now the price is $40.

Here is the problem, no body know where is the bottom of the market & not everyone have huge amount of capital to invest.

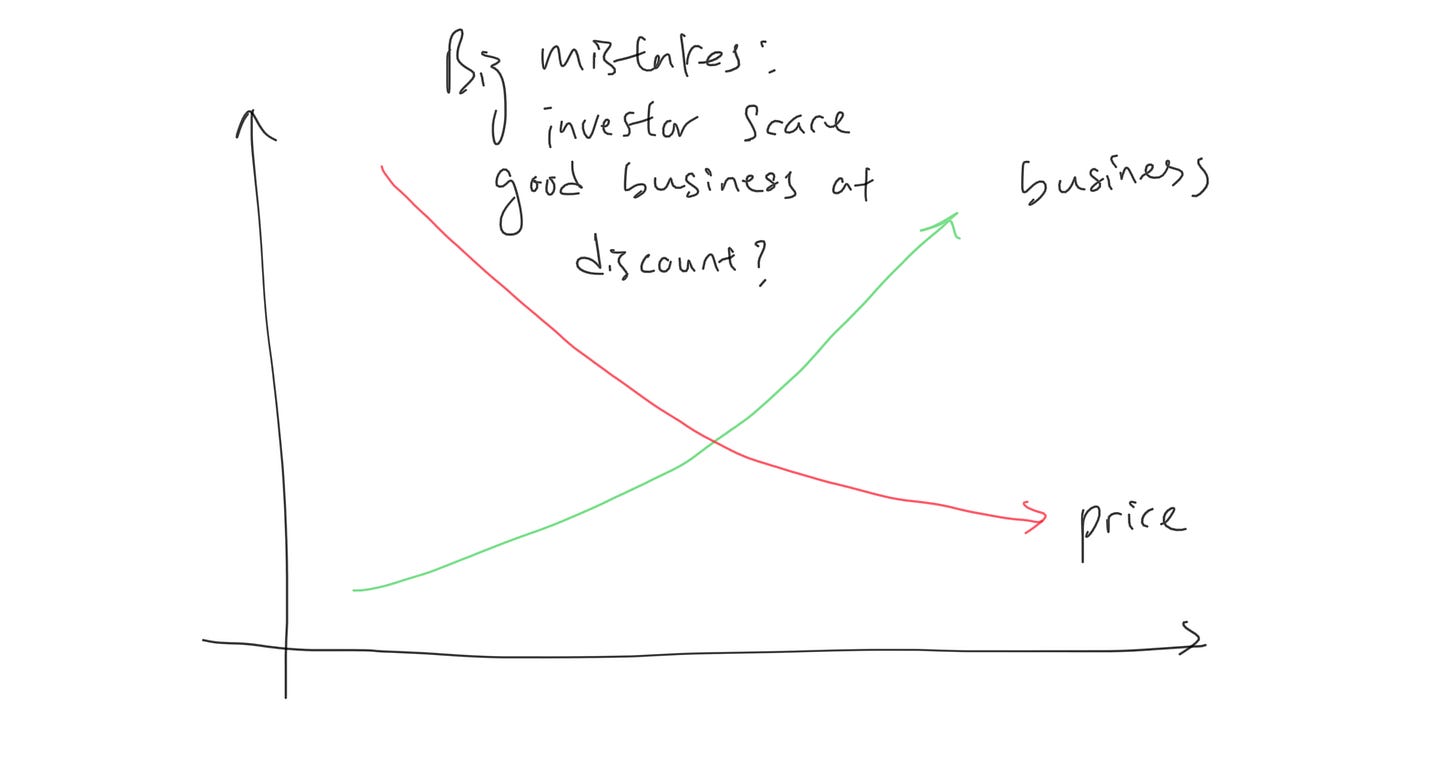

One common mistake novice investors make is selling a good business just because its stock price drops

For example, imagine Apple’s stock is $200 per share but falls to $170 after President Trump imposes tariffs on many countries.

Many new investors panic and sell, fearing the price will fall even more.

But Apple’s fundamentals remain strong: huge cash reserves, high profit margins, little to no debt, strong brand, and solid free cash flow.

Smart investors see this as a chance to buy more, since they are getting a great company at a cheaper price.

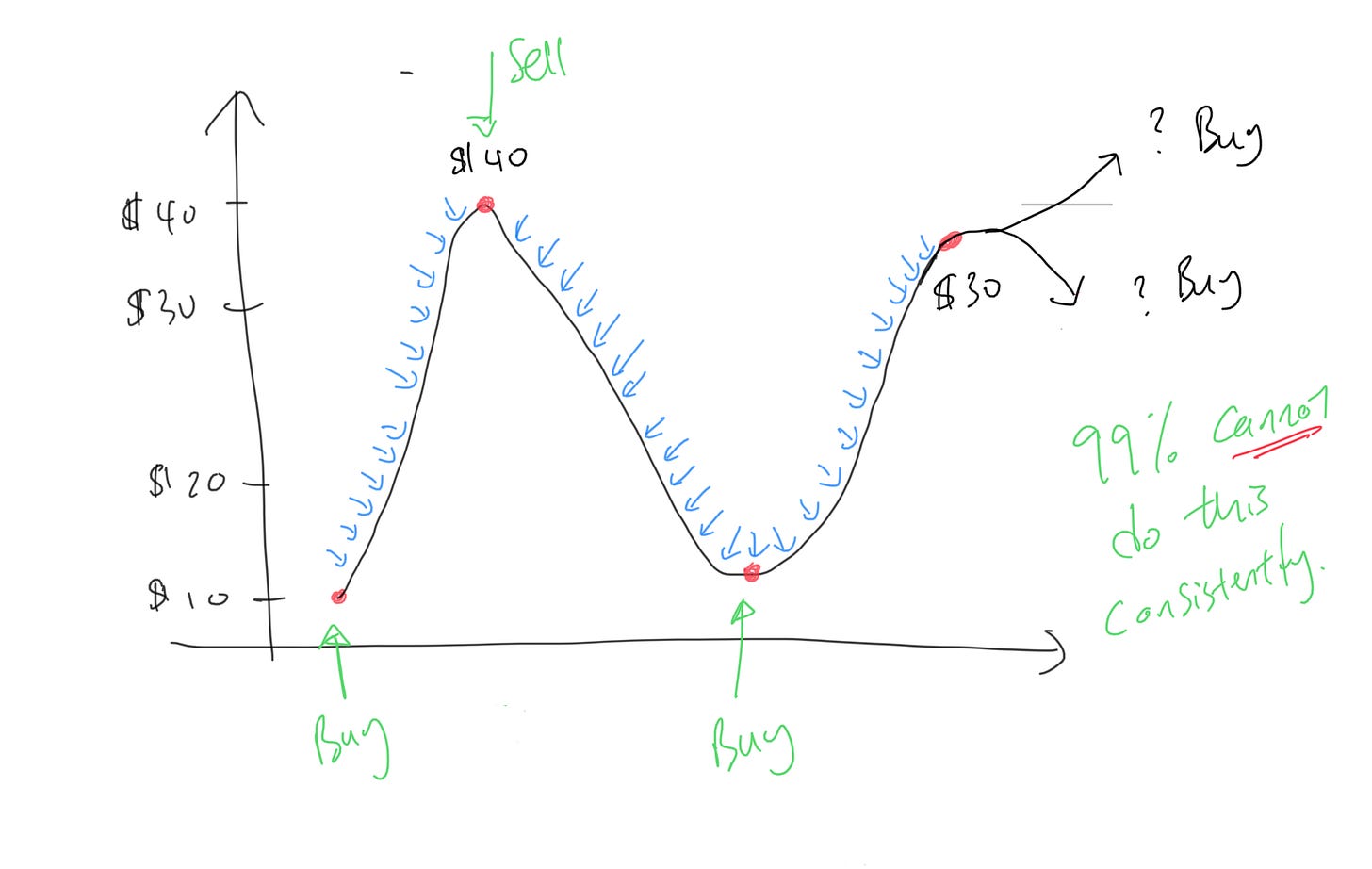

Since nobody can perfectly time the market , buy at bottom , sell at top what will be our best option to invest in the stock market / unit trust?

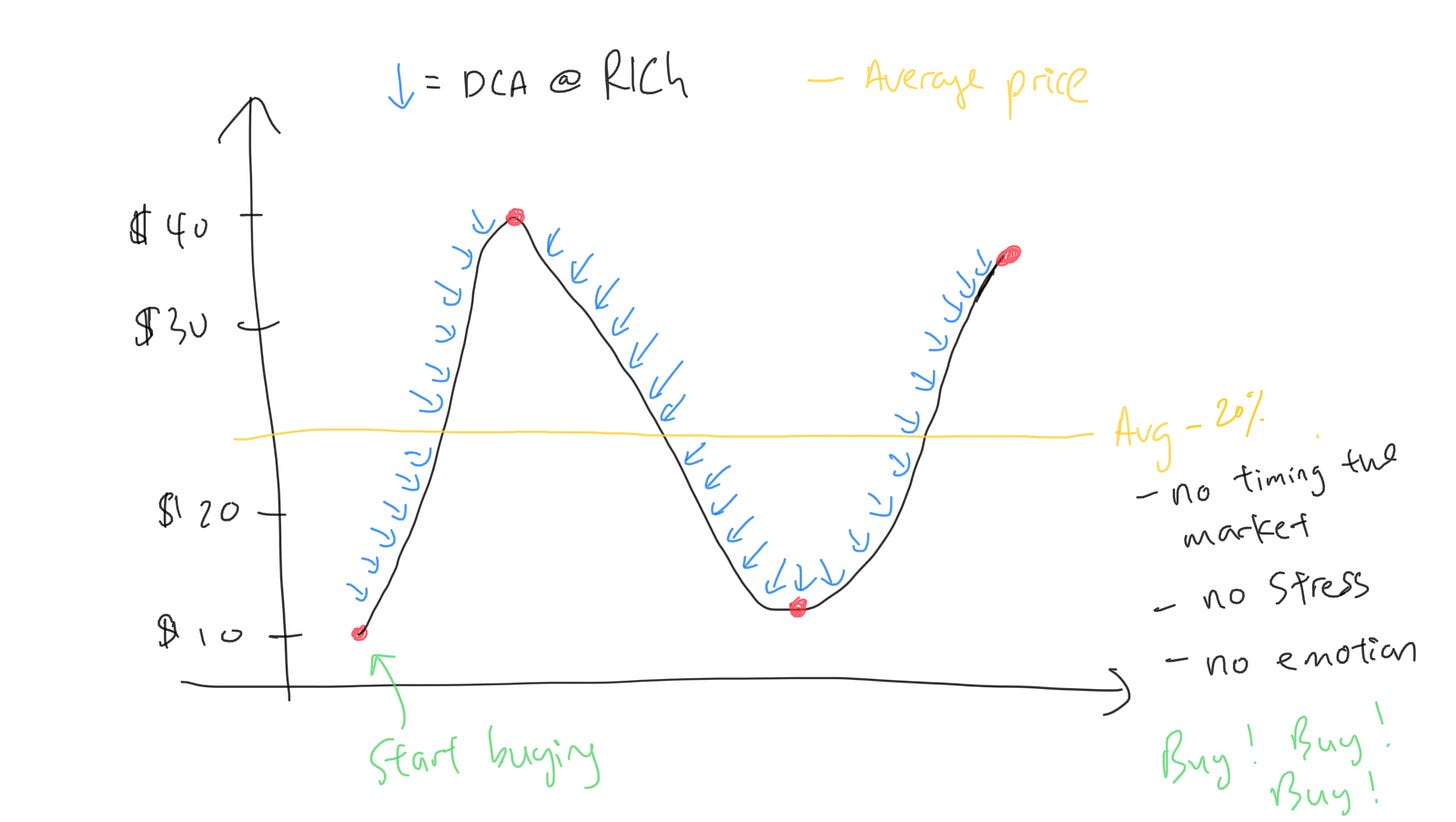

The answer is Dollar Cost Averaging (DCA). → An automatic monthly / weeklly Rregular Investment.

Because you dont need to time the market.

So this method eliminates emotion, because you keep buying regardless of market go up or down.

And you can sleep peacefully. No stress at looking at the market everyday

This is the proof that why DCA works

$100/month (RICh)

from 2015 until 2025 July

Total capital: $12K

Total return: $23,635

CAGR: 11.95% p.a

In my next article i will show you how you can further refine & optimised the DCA method.