How Regular Investing Saved My Wife’s Portfolio in a Bearish Chinese Market

The secret to why other investor lose -46.72% but my wife only lose -2%?

How do you deal when a fund truly sucks?

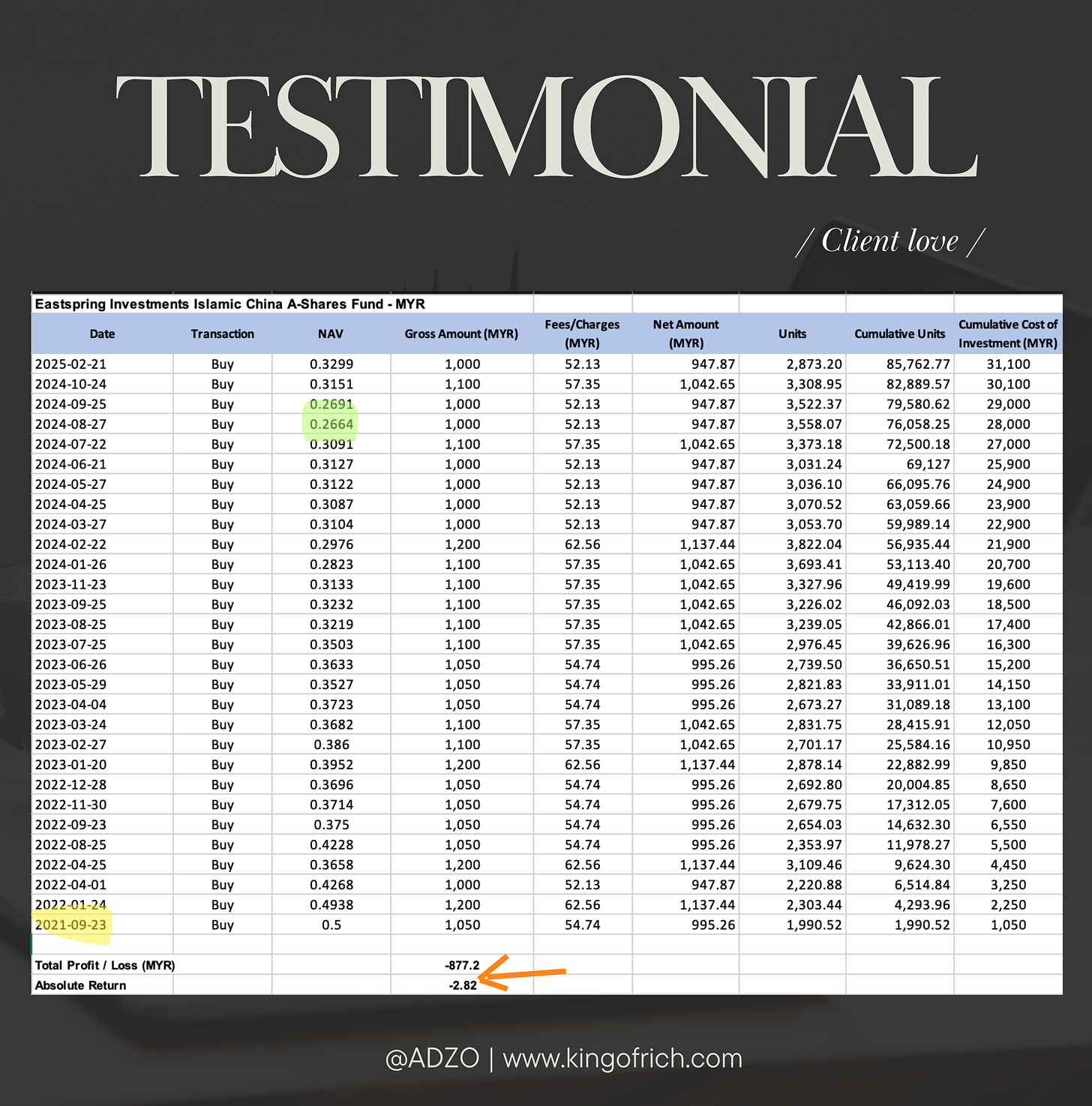

I vividly remember approaching my wife, asking her to invest in a brand-new fund from Eastspring Investments. I was convinced that China was the future—the world’s second-largest economy, soon to surpass the USA as the undisputed global economic champion.

She believed me because my proposal was too good to ignore.

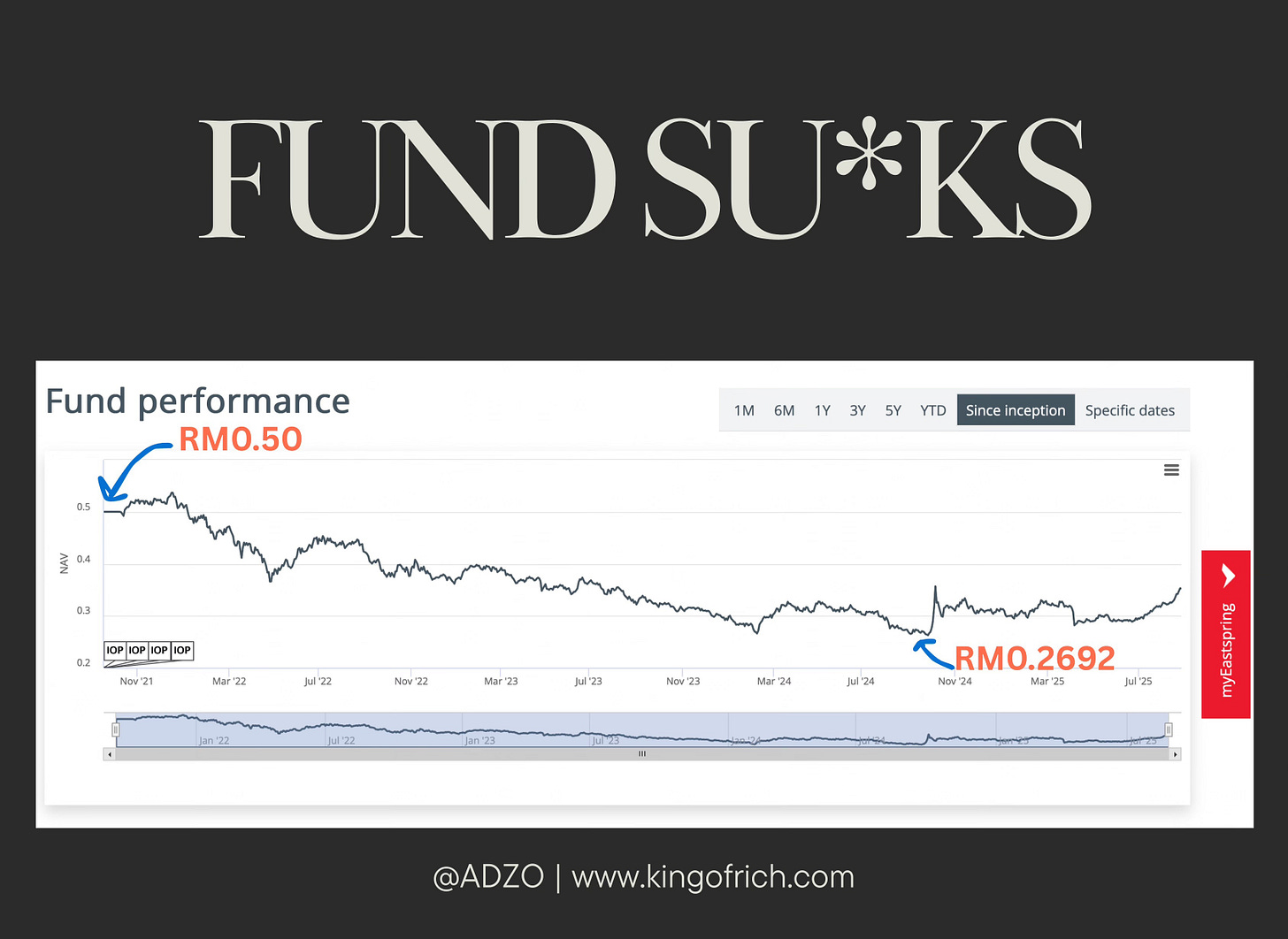

What happened since then was a nosedive in the Chinese market. It felt like the economy was on a long term diarrhea. Forgive me for the lack of better words. The fund’s price dropped from RM0.50 to RM0.2664—a staggering 47% loss!

If you’re not bothered by this, I salute you. You must have the heart of iron. To give you some context:

• If you invested RM5,000, it has now fallen to RM2,650.

• If you invested RM30,000, you’re left with just RM15,900.

She would have slapped me so hard that I wouldn’t have remembered my own name for losing HALF of her hard-earned money. Luckily, that didn’t happen.

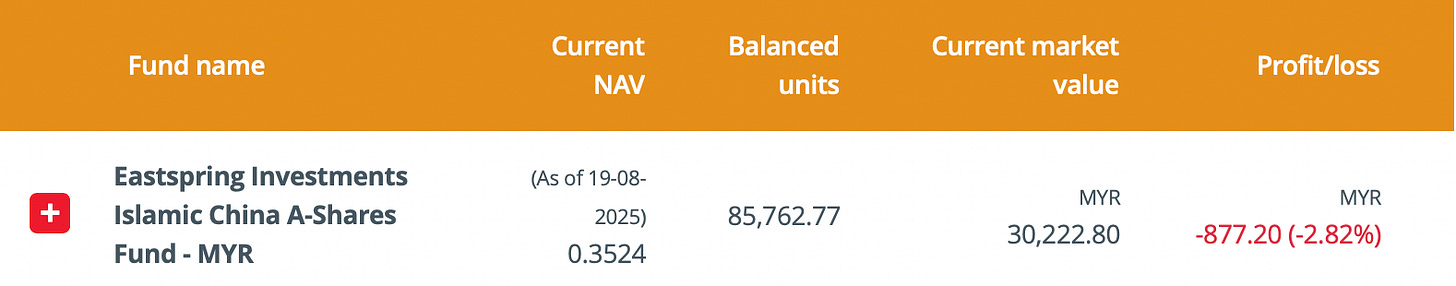

While other investors suffered a 47% loss, her portfolio only showed an unrealized loss of 2%. How is that possible?

What she did right was, instead of making a lump sum investment, she contributed regularly. By investing monthly or weekly, she bought units at different prices. At one point, she bought at RM0.50 per unit, and when the price dropped to RM0.26, she continued buying. This helps her to average the cost!

I’ve shared this strategy with my other investors why Dollar-Cost Averaging (DCA), or what I call the RICh method(Regular Investment for Compounding Wealth), is hands-down the smartest way to invest.

DCA was invented by some nerd back in the 1920s and 1930s in the U.S during the rise of mutual funds, this approach was designed to make stock market investing accessible to everyday people. It was later championed by Benjamin Graham in his 1949 classic, The Intelligent Investor, where he outlined a strategy of investing fixed amounts regularly to sidestep the pitfalls of trying to time the market. Here’s why DCA remains a game-changer for building wealth.

Where do i see China A will go from here?

If i am to make a Bear case (worst case scenario) this is how it lookss like from Technical Analysis Point of view

I am expecting the China A ETF to reach $38 in a "wave (C) blue" pattern, which you estimate would lift the Eastspring China A share NAV to RM0.4355

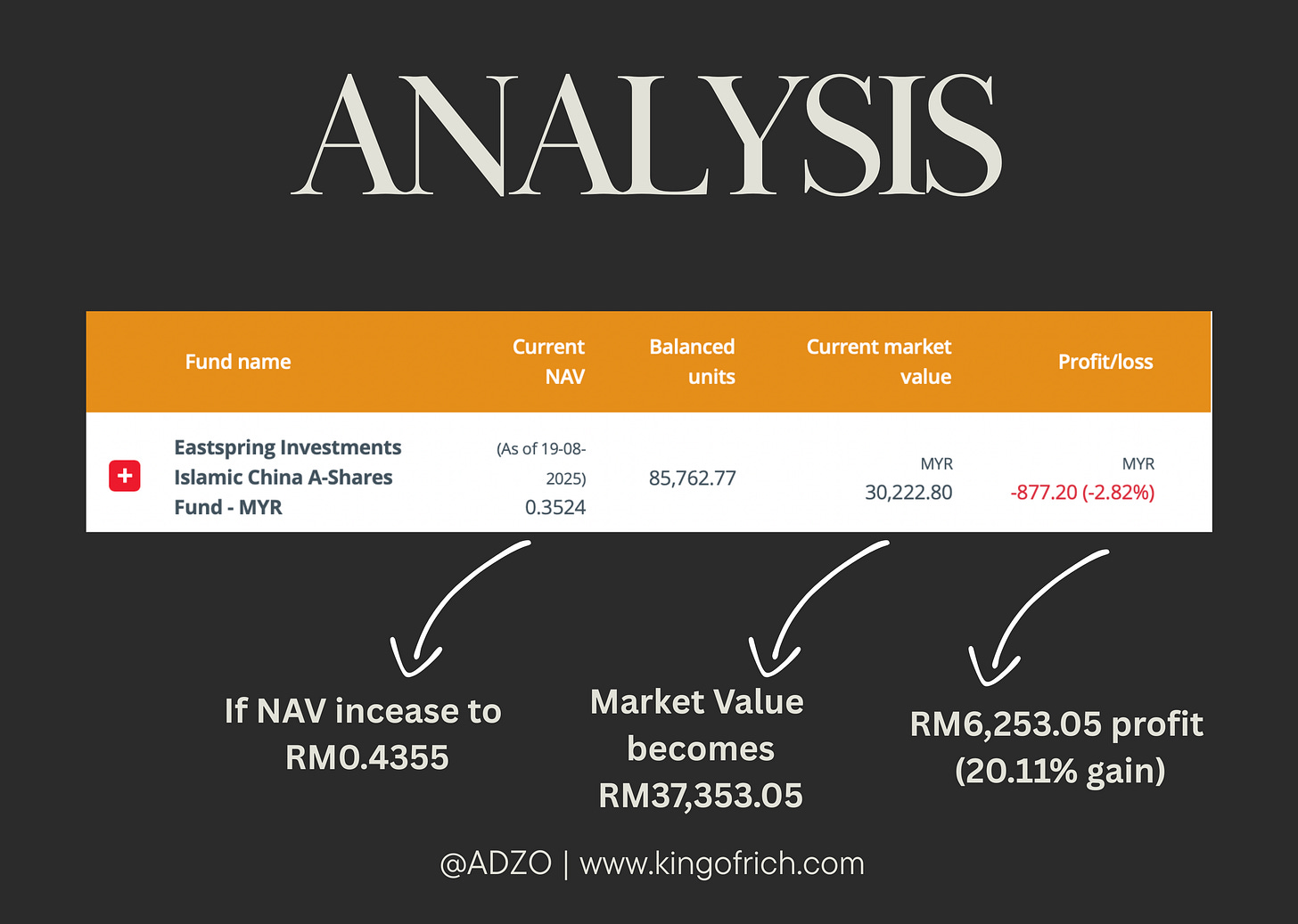

This is how it will reflect on my wife’s portfolio

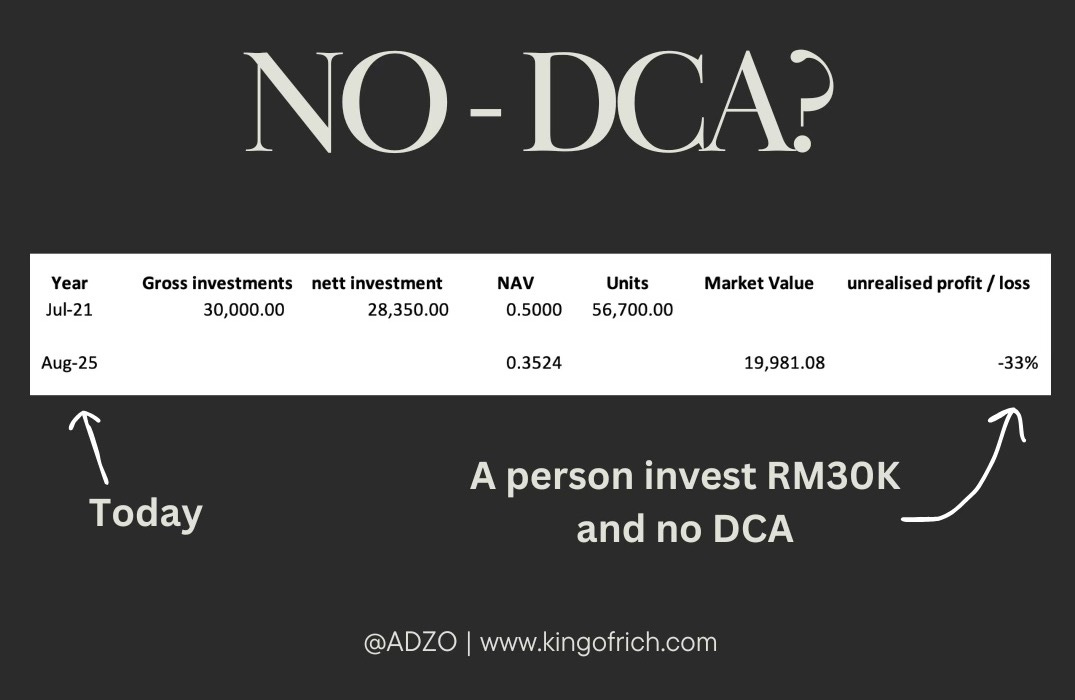

Now what happen to the guy that invest at RM0.50 and never do DCA?

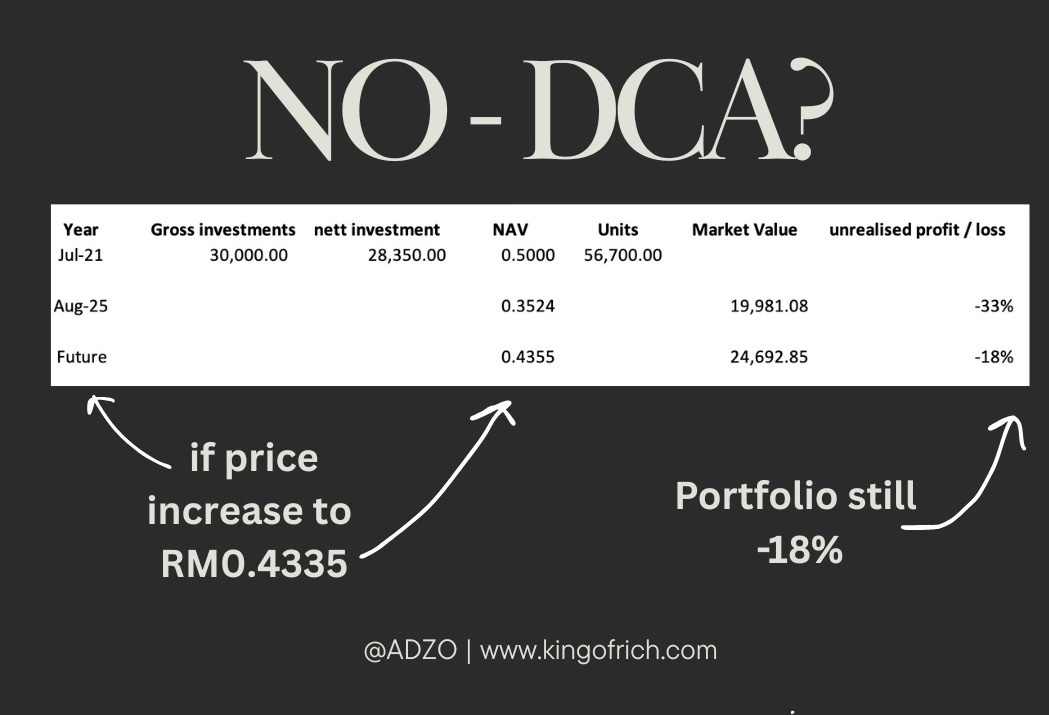

and even when the price went up to RM0.4355, they still underwater by -18%!

In conclusion, RICh method—our trusty Dollar-Cost Averaging secret sauce—is like the financial equivalent of eating chocolate every day: it smooths out the bitter market dips, builds wealth over time, and keeps you grinning like a kid with a candy stash! After that wild Eastspring fund rollercoaster (RM0.50 to RM0.2664,) sticking to regular investments ensures you’re not just surviving the crash but laughing all the way to the bank as the China A ETF hopefully hits that sweet $38. So, keep that RICh flowing—it’s your ticket to financial freedom.

i have dedicated an article of the magic of RICh here 👇🏼